Fractional & Virtual CFO Services UAE - Dubai or Abu Dhabi

Strategic Financial Leadership Without the Full-Time Cost

Get senior-level financial expertise exactly when you need it. DHAC provides fractional CFO, virtual CFO, and part-time CFO services to startups, SMEs, and growing businesses in Dubai, Abu Dhabi and across the UAE. Our outsourced CFO solutions combine Swiss financial precision with deep UAE market knowledge, bringing you CFO-level strategic guidance at 10-20% of full-time costs.

Whether you're searching for a fractional CFO in Dubai, Abu Dhabi or across the UAE, need virtual CFO services, or require interim CFO support for a critical project, our experienced team (led by a former SGS Group CFO) delivers the financial leadership your business needs to scale successfully

What is a Fractional CFO? (Virtual & Part-Time CFO Explained)

Also known as a virtual CFO, part-time CFO, or outsourced CFO</strong>, fractional CFO services in Dubai & Abu Dhabi provide the same strategic expertise as a full-time executive, just on a flexible, part-time basis. Whether you're a tech startup in DIFC, a growing SME in Dubai or Abu Dhabi mainland, or a family business across the UAE, our fractional CFO services deliver professional financial leadership tailored to your specific needs and growth stage.

Many businesses search for "virtual CFO Dubai" or "part-time CFO services UAE" when they need high-level financial guidance without the permanent commitment of a full-time hire. DHAC's outsourced CFO solutions bring together Swiss precision with deep UAE market expertise, giving you the best of both worlds at a fraction of traditional CFO costs.

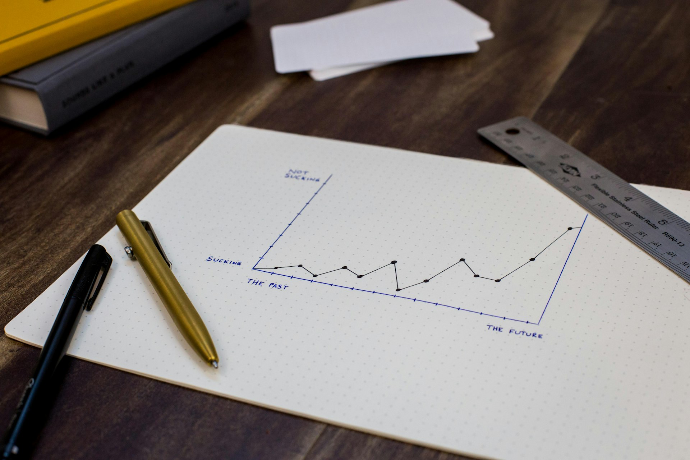

The Reality Check:

- Full-time CFO in Dubai: AED 50,000-80,000/month + benefits = AED 600K-1M+ annually

- DHAC Fractional CFO: AED 5,000-40,000/month = AED 60K-480K annually

You get the same strategic value. Just smarter resource allocation.

Do You Need Fractional CFO Services? Warning Signs

Most founders realize they need CFO-level support when they encounter these situations:

- Growth challenges : revenue growing but profitability isn't improving, you do not understand which products/services makes money, cash is tights despite showing profit, taking major decisions based on gut feeling rather than data

- Operational complexity : you have multiple revenue streams but can't track profitability by channel, month-end financials take 2-3 weeks to arrive, you are hiring more people but remain unsure if you can afford them, you do not understand your margins, your finance team need coaching, you need management report and financial ratios

- Strategic questions : investment decision review, what price should you charge, how to improve cash flow and working capital, what processes or financial system do you need as you scale ?

- Fundraising or Investment : investors are asking questions you can't confidently answer, you need financial projection but don't know where to start, banks rejected your loans du to poor financial documentation,

Why Choose DHAC's Fractional & Virtual CFO Services for your operations across UAE ?

DHAC CFO : what we can do for you ?

Build a Clear Roadmap for Profitable Growth

Financial Strategy & Business Planning

Scale Smart, Not Just Fast

What we do ?

Strategic financial planning: 3-5 year financial strategy aligned with your business vision, Annual budgeting: Realistic budgets based on historical data and growth targets,

Unit economics analysis: Understand profitability at the transaction level, Pricing optimization: Data-driven pricing strategies to maximize margins, Cost structure analysis: Identify waste and optimize spending without sacrificing growth

Scenario modeling: "What-if" analysis for major decisions (hiring, expansion, new products), Capital allocation strategy: Optimize how you deploy cash for maximum ROI

Growth alternatives : new market entry analysis, multi-currency management, business case development (ROI analysis before launching new offerings), Pricing strategy (set prices to protect margin), Buy vs build analysis, Integration planning and support

Deliverables: Strategic financial plan document, 12-month operational budget, Rolling 12-month forecasts (updated monthly), Scenario comparison models, Monthly variance analysis reports

Cash Flow Management & Working Capital Optimization

Never Run Out of Cash — The #1 Killer of Businesses

82% of businesses fail due to cash flow problems, not lack of profitability. We ensure you always have visibility and control over your cash position.

What we do ?

Cashflow : Understand your cashflow, 13-week rolling cash flow forecasts: Know exactly when money is coming in and going out,Cash runway analysis: Calculate how many months of cash you have left at current burn rate, Scenario planning: Model different growth scenarios and their impact on cash, Daily cash monitoring: Track actual vs. forecast and alert you to issues early

Working Capital Optimization: Accounts receivable acceleration: Strategies to get paid faster (improve by 15-30 days typical),Accounts payable optimization: Negotiate better payment terms with suppliers, Inventory optimization: Reduce cash tied up in stock (for product businesses), Cash conversion cycle improvement: Reduce the time from spending to earning

Credit & Financing advisory : Banking relationship management: Your advocate with UAE banks, Credit facility planning: Determine optimal debt levels and secure better terms, Alternative financing: Explore asset financing, invoice factoring, revenue-based financing, Covenant compliance monitoring: Stay compliant with loan requirements

Deliverable: Cashflow understanding, visibility and actionable action plan

Raise Capital with Confidence

Fundraising & Investor Relations

Securing investment requires more than a good idea — you need investor-grade financial documentation, compelling projections, and the ability to answer tough due diligence questions.

What we do ?

Investor Relations: Monthly/quarterly investor reporting: Professional updates with KPIs investors care about, Board presentation preparation: Financial sections of board decks, Stakeholder communication: Bridge between operations and investor

Fundraising Support: Financial model development: 3-5 year projections with detailed assumptions and sensitivity analysis, Business plan creation: Comprehensive plans that investors and banks actually read, Pitch deck financials: Clear, compelling financial slides that tell your growth story, Valuation analysis: Pre-money valuation and equity dilution scenarios, Use of funds planning: Detailed breakdown of how you'll deploy capital, Due diligence preparation: Organize all financial documentation for investor review, Term sheet analysis: Review investment terms and negotiate favorable conditions, Cap table management: Track equity ownership through multiple funding rounds

Transform Financial Data into Actionable Business Intelligence

Management Accounting & Operational Excellence

What we do ?

Management Accounting Services: Cost accounting & analysis: Detailed breakdown of costs by department, product, project, or service line, Margin analysis by segment: Understand profitability at granular level (product, customer, channel, geography), Break-even analysis: Calculate break-even points and contribution margins for pricing decisions, Activity-based costing: Allocate overhead accurately to understand true product/service costs, Budget vs. actual reporting: Monthly variance analysis with commentary on drivers

Financial Ratio Analysis: Liquidity ratios: Current ratio, quick ratio, cash ratio — monitor ability to meet short-term obligations, Profitability ratios: Gross margin, EBITDA margin, net margin, ROE, ROA, Efficiency ratios: Inventory turnover, receivables turnover, payables turnover, cash conversion cycle, Leverage ratios: Debt-to-equity, interest coverage — assess financial health and borrowing capacity, Growth metrics: Revenue growth, profit growth, market share trends, Industry benchmarking: Compare your ratios against competitors and industry standards

Business Piloting & Decision Support: Weekly/monthly management packs: Concise reports for management decision-making, Product/service line profitability: Decide which offerings to expand, maintain, or discontinue

Interim Financial Leadership: FD/CFO replacement, Crisis management support: Provide financial leadership during difficult periods, Transformation projects: Lead major changes (system implementation, restructuring, turnaround)

Team Coaching & Development: Mentor your accountants, controllers, and analysts, Management financial literacy training: Help non-financial managers understand financials, Best practices transfer: Teach advanced techniques (forecasting, modeling, analysis), Process improvement workshops: Work with your team to optimize workflows

Expected results : Margin improvement, faster decisions and stronger team capability

Protect Your Business from Financial Risks

Risk Management & Internal Controls

Peace of mind: Our clients sleep better knowing financial controls are solid.

What we do ?

Risk Assessment & Mitigation: Financial risk assessment & mapping: Identify and quantify business risks, Insurance review: Ensure adequate mitigation measures or coverage for key business risks, Regulatory compliance monitoring: Track all financial and tax deadlines, Foreign exchange risk management: Hedging strategies for international operations

Fraud Prevention & Internal Controls: Segregation of duties: Ensure no single person controls entire financial processes, Approval hierarchies: Multi-level approvals for significant transactions, Periodic reconciliations: Regular checks to detect discrepancies early, Internal Policy enforcement: Prepare and circulate Clear rules and processes, Support with Internal audit reviews: Quarterly or annual review of financial controls

Frequently asked questions

Everything You Need to Know About Fractional CFO Services

feel free to reach out for any other question

- Bookkeeper: Records transactions (backward-looking, operational)

- Accountant: Prepares financial statements and ensures compliance (backward-looking, tactical)

- CFO: Provides strategic guidance and financial leadership (forward-looking, strategic)

Fractional CFO and virtual CFO are often used interchangeably to describe part-time, outsourced CFO services. The main difference: a fractional CFO typically includes some on-site presence in your Dubai office (2-8 days per month), while a virtual CFO works primarily remotely using cloud-based tools and video meetings. At DHAC, we offer both fractional and virtual CFO services to match your preference and business model

You need all three, and most businesses confuse them. DHAC provides complete coverage across all three levels.

Fractional CFOs work part-time (typically 2-8 days per month) and serve multiple clients. You get the same strategic expertise and seniority as a full-time CFO, but at 10-20% of the cost.

Perfect for businesses that need CFO-level guidance but can't justify (or afford) a full-time executive salary of AED 600K-1M annually.

You typically need CFO services when you experience any of these:

- Raising external funding (seed onwards)

- AED 5M+ annual revenue

- 10+ employees

- Facing growth decisions without clear financial analysis

- Cash flow becoming unpredictable

- Considering major investments (new products, locations, acquisitions)

- Preparing to sell the business

No.

Accountants are excellent at compliance, tax filing, and historical reporting. CFOs focus on strategy, planning, and forward-looking decision support. They're complementary roles. Your accountant tells you what happened last month; your CFO tells you what to do next month.

No.

Not necessarily. We can work alongside your existing team, providing strategic guidance while they handle day-to-day bookkeeping. However, many clients prefer our integrated approach where we provide both bookkeeping and CFO services for seamless coordination.

Depends on your needs, alternatively we have multiple packages

- Startup: 2 days/month + monthly 1-hour meeting

- Growth: 4 days/month + bi-weekly meetings

- Enterprise: 6-8 days/month + weekly touchpoints

Plus ad-hoc availability via email/WhatsApp between scheduled times.

Fractional CFO services in Dubai typically range from AED 5,000 to AED 40,000 per month, depending on your company size, complexity, and the number of days required.

This represents just 10-20% of a full-time CFO's total cost (AED 600,000-1,000,000+ annually including salary, benefits, and overhead). Most startups and SMEs find that part-time CFO services deliver the same strategic value at a fraction of the investment.

Yes! Our virtual CFO services are designed for remote and distributed teams across Dubai, UAE, and internationally. We use secure cloud-based financial platforms, video conferencing, and collaborative tools to provide seamless CFO-level support regardless of your team's location. Many of our clients operate hybrid models with teams across multiple UAE emirates or globally, and our virtual CFO services integrate perfectly with modern, flexible work arrangements.

Dedicated. You'll work with the same senior CFO throughout your engagement. Continuity and deep business knowledge are essential for effective strategic advice.

Both. Most of our work is remote using cloud tools and video meetings (more efficient for everyone). For Enterprise clients, we're happy to visit your office monthly or for key strategic sessions.

Typically within 1-2 weeks. We'll have an initial consultation, then:

- Week 1: Discovery and access setup

- Week 2: First strategic meeting with initial observations

- Ongoing: Regular cadence per your package

DHAC is committed to provide high level of services allowing our customers to grow and overcome their challenges. Our differentiating factor could be summarize as follow : Senior-level team — 15+ years experience (with major group), not junior consultants, Long-term thinking — average client stays 4+ years; we're invested in your success, Integrated services — we can provide bookkeeping, tax, payroll, AND CFO (seamless), Data-driven approach — every recommendation backed by modeling and analysis and part of our DNA Swiss quality standards with UAE market expertise

Yes! We serve clients across all seven UAE emirates (Dubai, Abu Dhabi, Sharjah, Ajman, RAK, Fujairah, UAQ). We also work with international businesses expanding into UAE or UAE businesses going global.

Ready to Elevate Your Financial Strategy?

We'd love to hear from you! Whether you have questions, feedback, or need support, our team is here to help. Simply fill out the form below, and we aim to respond to all inquiries within 24 hours. Thank you for getting in touch!

+971 54 302 23 45

Dubai, UAE