Digital Invoicing for Dubai SMEs: Automate with Odoo

In Dubai and across the UAE, many SMEs still manage their quotes in Excel, their invoices in Word, and their customer follow-up through scattered emails. This works initially... but as your business scales, it becomes unmanageable.

The Reality:

- Manual data entry errors costing thousands of AED

- Extended payment cycles affecting cash flow

- VAT compliance risks with FTA audits

- Lost visibility on accounts receivable

Whether you're operating in a Dubai Freezone (DMCC, JAFZA, DAFZA, DIFC,..), Abu Dhabi Freezone (ADGM, KEZAD, ..) or Mainland, manual invoicing is holding your growth back.

The Real Cost of Manual Invoicing in UAE

Creating invoices manually creates significant business friction:

- 90 minutes average to create, send, and track each invoice

- 15% error rate in invoices generated with Word or Excel

- 45% longer payment cycles without automated reminders

- Revenue leakage from forgotten invoices or missed follow-ups

- VAT compliance risks with manual calculations

But the deeper problem is process fragmentation: quotes in Excel, invoices in Word, customer tracking in emails, VAT records in spreadsheets... How can you scale a modern Dubai business under these conditions? and how to be ready for UAE e-invoicing in 2026 and 2027?

DHAC & Odoo: The Integrated Solution That Streamlines Your UAE Business

With DHAC and Odoo, you consolidate quotes, sales orders, and invoices in one digital environment. No double entry, no forgetting, no VAT errors: everything is automated, traceable, and FTA-compliant.

From Quote to Invoice in One Click

- Professional quotes created from your product catalogue

- Automatic conversion of accepted quotes into invoices

- Zero re-entry = Zero errors

- Real-time visibility on each customer's journey

- Multi-currency support (AED, USD, EUR, GBP) for international clients

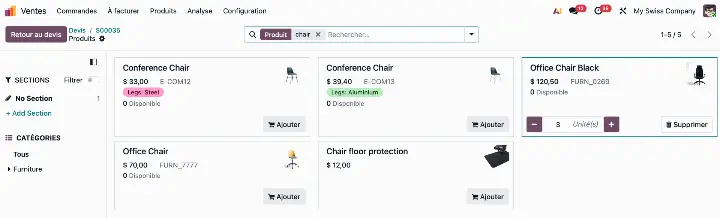

(product catalogue - to add your products/services to the quote in two clicks)

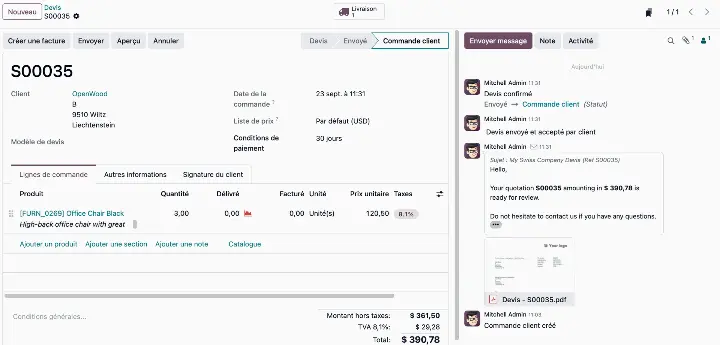

(online quotes - prepare your quotes online, manage sending and client confirmation, track deliveries and issue the final invoice in two clicks)

Smart and Compliant Invoicing for UAE

- Invoices generated according to your rules (order-based, delivery-based, periodic)

- 5% UAE VAT automatically calculated and recorded

- FTA-compliant invoice formats with all required fields

- Custom templates matching your brand

- Multi-currency integrated for your international operations

- Automatic TRN (Tax Registration Number) inclusion

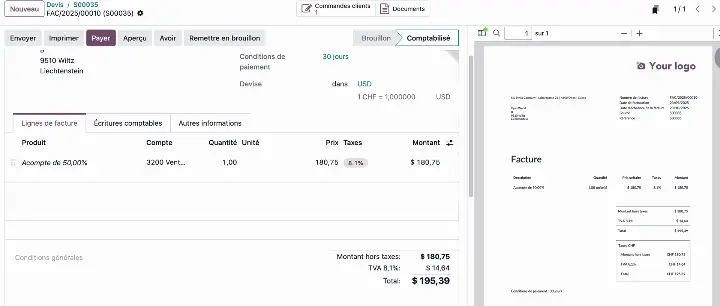

(Invoice generated and accounted for in 3 clicks - keep all your documents online)

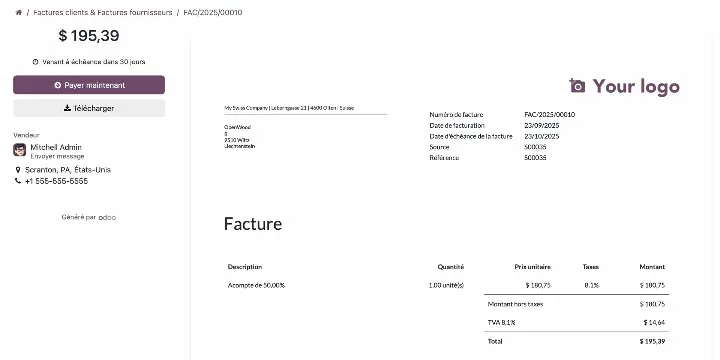

(Client portal: encourage your clients to visit their dedicated portal)

Critical for UAE: Odoo automatically includes all FTA-required invoice elements:

- Supplier and customer TRN

- Tax invoice designation

- VAT breakdown by rate

- AED totals even for foreign currency invoices

Payment Tracking and Automated Reminders

- Automated payment reminders based on your settings

- Clear dashboard of customer balances in AED

- Automatic bank reconciliation with UAE banks (Emirates NBD, ADCB, FAB, Mashreq)

- Alerts on overdue payments for immediate action

- Integration with UAE payment gateways

(Outstanding receivable in 2 clicks, track and remind easily your customer)

DHAC & Odoo 19: Game-Changing Features for Dubai Businesses

Version 19 (September 2025) delivers critical capabilities:

Integrated AI:

- Automated product descriptions in English and Arabic

- Predictive payment behavior analysis

- Smart billing suggestions

Redesigned Mobile Interface:

- Manage quotes and invoices from anywhere in Dubai

- Mobile-first design for on-the-go entrepreneurs

Business Expense Card:

- All professional expenses automatically recorded

- Seamless integration with UAE accounting

ESG Module:

- Environmental reporting aligned with UAE Net Zero 2050

- Ready for upcoming sustainability disclosure requirements

Customer Success Story: Dubai Trading Company

"Before Odoo, our admin team spent 2.5 days weekly on invoicing and VAT compliance. Today, it's completed in half a day. Zero VAT errors, no missed payment reminders, and complete confidence during FTA reviews."

Managing Director, DMCC-based Trading Company (12 employees)

Tangible ROI for Your Dubai SME

Immediate Returns:

- 70% reduction in time spent on invoicing

- 30% faster payment collection

- Zero VAT calculation errors

Strategic Control:

- Real-time cash flow dashboards

- Accurate revenue forecasts in AED

- Complete audit trail for FTA compliance

Scalability:

- Odoo grows with your business

- Add CRM, inventory, HR, or projects as needed

- Supports multi-entity (Freezone + Mainland structures)

Why DHAC and Odoo Makes Sense for UAE SMEs

For Freezone Companies:

- Simplified 0% VAT handling for qualifying transactions

- Multi-currency by default for international trade

- Compliance with Freezone and FTA requirements

For Mainland Companies:

- Full 5% UAE VAT automation

- Integration with local banks and payment systems

- Support for Arabic and English documentation

For Growing Businesses:

- Scales from 3 to 300+ employees

- No per-user pricing traps

- One system for sales, accounting, and operations

Conclusion: Stop Managing Your Dubai Business with Spreadsheets

Running invoicing on Word and Excel in 2025 is like navigating Dubai traffic with a paper map. It might work... but you'll never reach your destination efficiently.

With DHAC & Odoo, you transition to a streamlined, automated invoicing process that's:

- FTA-compliant from day one

- Designed for UAE cash flow realities

- Built to scale with your growth

At DHAC UAE, we help Dubai-based SMEs and startups implement Odoo as their growth engine.

We combine Swiss accounting precision with UAE market expertise to deliver digital transformation that actually works.

Ready to Eliminate Manual Invoicing?

Book your free process audit with DHAC UAE

- Discover where you're losing time and money

- Get a customized Odoo implementation roadmap

- Learn how Dubai SMEs are achieving 70% time savings

Contact DHAC UAE:

- 📧 Email: info@dhac.ch

- 📱 WhatsApp: +971 54 302 23 45

Tags: #OdooUAE #DubaiSME #DigitalInvoicing #VATCompliance #DubaiAccounting #FreezoneAccounting #DHACUAE #SMEAutomation #DubaiERP